Disasters come in all forms. By evaluating your agricultural business, you can be ready for anything. Check out these steps to evaluate your business.

When you are in the business of agriculture, disaster comes in many forms. There are the droughts that leave you with dust to feed your cattle. Flooding rains can leave major damage to the crops and hay you were counting on harvesting. And then, there’s the global market shifts that affect every farmer and rancher at any given time.

Is your agricultural business ready for a disaster? When was the last time you evaluated your farm or ranch?

How will you handle this major profit-changing event?

When we experience global market shifts or extreme weather conditions, we are not alone. Every business owner in our area or line of operations will feel the impact. But, the operators who have planned for everything to go wrong are the ones who will come out on top. Not untouched but stronger in the end.

No matter where you are in your business, you can and should be constantly evaluating your operations.

How to evaluate your business for a disaster

Plan A, B, C, D, E, F…

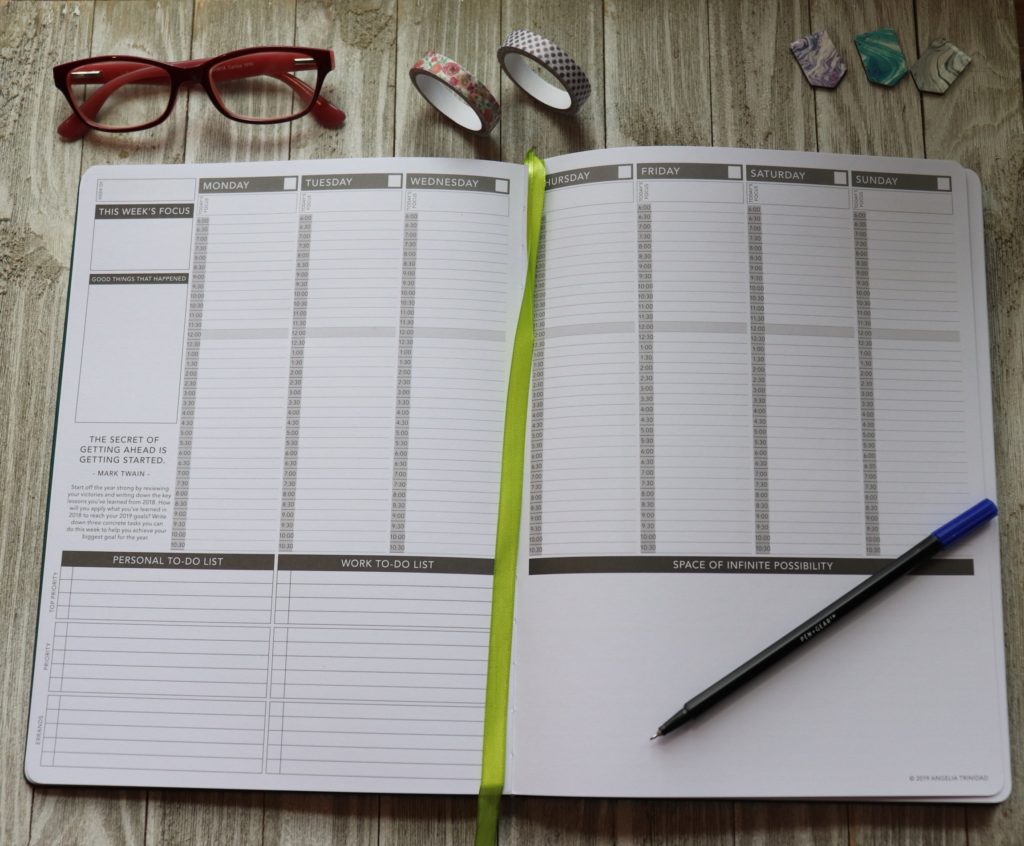

It’s hard to know if you are on the right track for your business without knowing where you were going from the beginning. If you don’t have a business plan and a set of goals you are working towards, this is the time to make that happen.

There is no need to wait until the end or beginning of a year to do this. Although your fiscal year may begin and end at a certain time, your business will constantly need guidance. Without knowing where you want your business to go, you will not be going anywhere. Know where you want to go as soon as you can so that you can map out the actions you need to take to get there.

Planning and goal setting is a guide and measurement of your business to determine how your business is growing and being affected. Leaning on coffee shop talk or news reports for the latest facts will not fully help your business. Your neighbor may say he won’t survive the drought. If you think along the same path your neighbor is on, you may forget that you can implement necessary changes to your business now so that it will survive.

Evaluating your Business

With your plan in hand, let’s take a look at where you are in your journey. No two owners will be at the exact same place at the same time. So, try to avoid looking over the fence at someone else’s operation. Their goals are not the same as your goals. Therefore, any actions or changes they may make in their business will not benefit you.

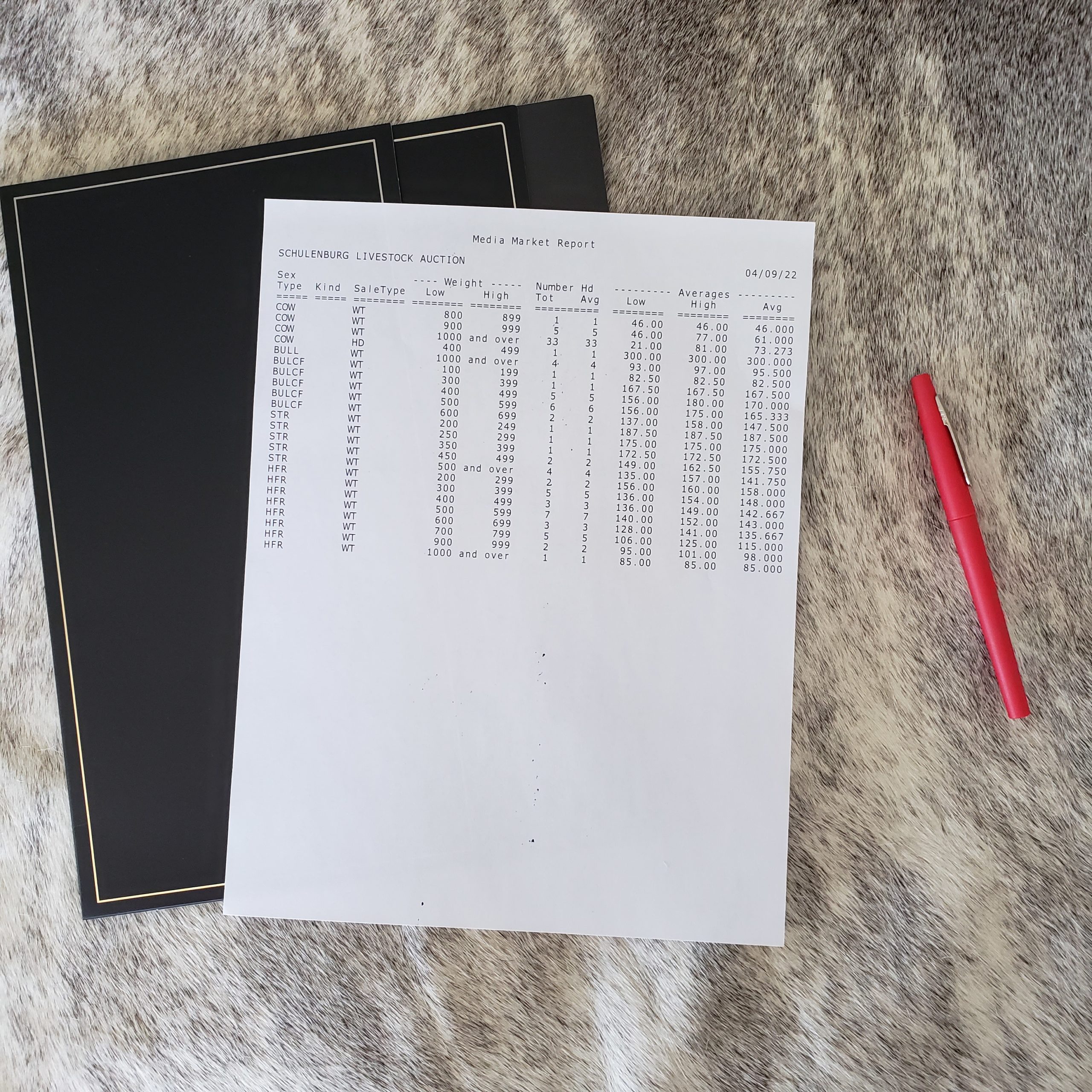

Let’s use an example of a crop of 20 steer and heifer calves. Your original plan was to keep them until they were 500 pounds and then take them all to your local sale barn. You have a month before you were going to haul them to a sale.

At the present moment, you obviously can’t predict what the market or weather will do. But, you can do a series of calculations on how the best and worst-case price scenarios would unfold. From each calculation, you can determine several outcomes:

- Wait x number of days to sell and reevaluate the market

- Sell now and purchase new calves at a later date

- Sell half of the animals now and hold the others for a later date

- Hold the heifers and implement a replacement program

- You will sell all animals now and hold your funds

Can you see how knowing where you want to go will help you get to where you want to go?

If you decide to hold any of these animals and alter your plan for them, you will need funds to carry them through. You will have to know if putting more money into them now will help you get enough money out of them later. Simply breaking even defeats the purpose of your attempt at a profit.

Evaluate Your Books

Profit is the fuel of your business. Without profit, you will not be able to continue to run your operations. Do not fall into the trap of false profits. This happens when you think you are making money in your business simply because you are cashing checks and making ends meet.

You will not be able to assess the financial health of your business if you wait until the following year to do your bookkeeping. I recommend you have (at the very least) a weekly date with your books. When you have a constant report on the health of your business, you are better prepared to make the best decisions for your company with little to no hesitation.

Your ability to think fast with educated thoughts in a financial or environmental crisis will better ensure your rebound or total avoidance from profit loss. Keep in mind, agricultural business disasters come in all forms and can come without warning.

Check out QuickBooks for your business.

Evaluate Possible Scenarios

Using the outcome from above, let’s look at this from a financial perspective:

- Wait x number of days to sell and reevaluate the market

- What will it cost you to keep these animals beyond your original sell date?

- Do you have space and feed/grazing resources to keep them beyond your original sell date?

- Sell now and purchase new calves at a later date

- What is your projected profit right now?

- What will your estimated cost be to purchase animals at a later date?

- How will your environment and climate change at your estimated purchase time?

- What will your estimated feed and forage costs be?

- You will sell half of the animals now and hold the others for a later date

- How will you decide which animals to keep and which ones to sell?

- What will be the determining price that you will sell the other half for?

- What is the estimated cost you can expect in holding half of the animals over?

- Will your profits from selling half of the animals be lost by keeping the other half for longer?

- Hold the heifers and implement a replacement program

- Are all of the heifers legitimate replacement prospects?

- Do you have the funds, time, and land to carry you through on this long term project?

- What are the necessary veterinary expenses you will incur to vaccinate and manage these animals?

- What is your estimated selling date?

- How will you market these animals and what will the estimated cost of that be?

- What is your estimated profit?

- You will sell all animals now and hold your funds

- What will your next investment be?

- When do you anticipate beginning this investment?

As you can see, you will need to know where you are going and how much it will cost you to get there. Your goals and your bookkeeping go hand in hand.

Trim the Fat

When your revenue is diminished, it is too late to look at where your money went. During your evaluation, take a good look at the whole picture of your operation. It is important to be honest with yourself as to what is truly working and staying profitable.

Every business owner wants to make money. If you are in this for the fun or for the loss, then you are not a business owner, you are a hobbyist. Without profit, there is no business.

By pulling your funds from the parts of your business that are sucking your account down, you can funnel more money into investments in your business that are making money.

This will keep your losses down and your cash flow stronger.

Explore New Income Streams

During a disaster, you may find that your current income streams are not working for you as strongly as you would like them to. After you evaluate your business, you may need to add a new profit idea into your operation to keep your profits coming in.

One of two things will happen when you add in a new form of revenue:

- You will gain your minimum goal profit margin

Or

- You will not gain your minimum goal profit margin

Your new business revenue cannot cost more than you have to put into it. The cost to implement the new revenue cannot cost more than the income you would make from it.

The goal of the added revenue is to make money for you while the other part of your business is in decreased profit production. Do not go into debt attempting to make more money. Remember, cashing a check does not mean you are making money.

Take an inventory of the equipment, funds, space, and time you have available. Brainstorm revenue streams you can produce from the resources you have on hand. From that list, determine what is in demand in the disaster you are currently in. This will help assure you have a strong revenue stream when this occurs again.

Let’s use a flood in your area as an example.

You have knowledge of rebuilding a destroyed fence. Your equipment can handle minor debris clearing and fence fixing. With a few supplies, insurances, permits, and time, you can put together a small fencing operation to add to your revenue. Add in a few tasks such as cutting and clearing debris, and you can have an income stream with minimal cost to get started.

No disaster will last forever, so make sure anything that you invest in will pay for itself quickly.

Take your brainstorm one more step.

Evaluate the potential profit you could have by extending this new revenue idea into another disaster scenario. Will your idea allow you to be profitable during a drought? Or a cattle market crash? The more reliable the income is, the greater the chance of diversifying your income safely.

Knowledge is Power

Correction. Knowledge without action is pointless.

Now that you have evaluated your current income and possible income ideas, you will have the upper hand in a disaster. By keeping a constant hand on your business, you will be more prepared to make any necessary adjustments when a disaster threatens your business.

With continued evaluation, your business will continue to meet your income needs and goals and keep you on the path to profits. Your agricultural business can survive a disaster.